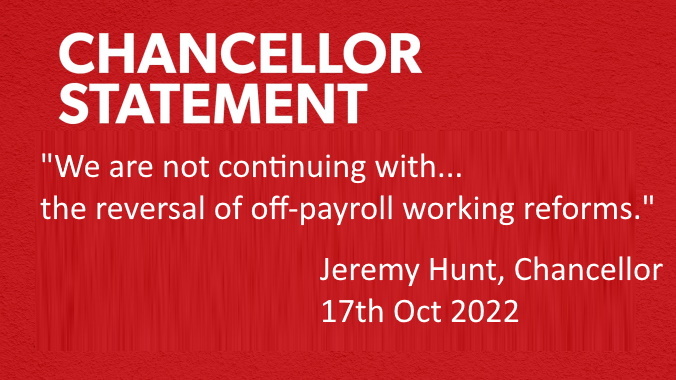

The Chancellor of the Exchequer, Jeremy Hunt, has chosen to scrap the plans to repeal the Off-payroll IR35 Reforms, which Kwasi Kwarteng previously announced in his mini-budget on 23 September 2022.

The Growth Plan had set out steps to take the complexity out of the tax system and identified the necessity of repealing the 2017 and 2021 off-payroll working rules (IR35 Reforms).

The Conservatives Growth plan indicated that repeal would "free up time and money for businesses that engage contractors, that could be put towards other priorities." And that it "also minimises the risk that genuinely self-employed workers are impacted by the underlying off-payroll rules."

The Treasury statement fails to say why they are not continuing with the failed IR35 reforms, and simply allude to the fact they need the money.

Commenting on the Chancellor's move to revoke the repeal, Dave Chaplin, CEO of tax compliance firm IR35 Shield said:

"The government's initial commitment to repealing the Off-Payroll rules was a sensible initiative and would have been a significant step forward for the UK's army of self-employed people who are critical to the Governments' pro-growth agenda.

"Repealing Off-payroll would have returned an essential level of certainty to contract transactions in the market economy, leading to economic growth. Instead, Off-payroll will continue to cause significant harm to the self-employed, major businesses, the government, and the economy.

"Whilst we agree that tax avoidance measures are sensible, the Off-payroll rules over-extended, causing genuinely self-employed contractors to lose their rights to be their own boss.

"The Conservatives U-turn on the repeal has thrown around half of the genuinely self-employed contractors under the bus and likely kissed goodbye to their success at the next General Election.

"With the anti-growth effects of Off-payroll, it appears the pro-growth Conservatives have now joined the Anti-Growth Coalition – as the saying goes ', we are all in this together."