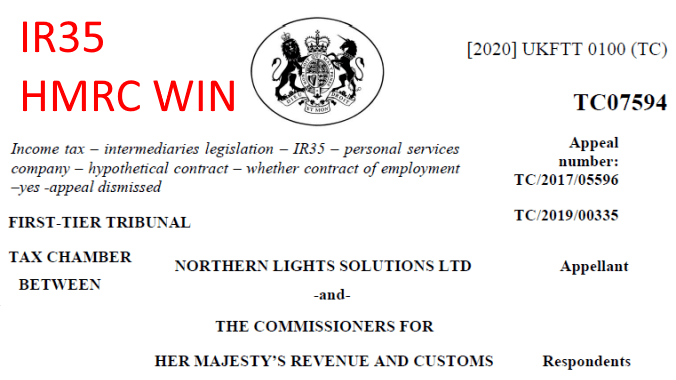

HMRC has secured a rare victory over a contractor in the latest IR35 tax tribunal ruling to emerge. Project manager Robert Lee lost his appeal against HMRC concerning a tax bill exceeding £70,000 for a series of contracts between his limited company, Northern Lights Solutions Ltd, and the Nationwide Building Society from 2012 to 2015.

In reaching his decision, Tribunal Judge Ian Hyde noted: “With few gaps Mr Less has worked for Nationwide for a number of years full-time in substantially the same project management role.

“During the course of a contract Nationwide had the right, albeit not exercised, to direct where Mr Lee worked and to require him to work a professional day. Mr Lee had in practice a considerable degree of operational and personal autonomy but was subject to overarching controls.”

“Overarching controls” prove calamitous for contractor

The tribunal found that, in practice, little control was exerted over Lee or his work, and his contracts did not permit Nationwide to move him onto another project without his consent. However, crucially, granted the bank’s “need as a highly regulated business to monitor the progress of the relevant project”, it was determined that Lee was subject to an overarching degree of control.

Lee also paid the price for his apparent close ties with Nationwide for the period in question. The tribunal observed that he was subject to little financial risk, aside from the perceivably minor risk of not being engaged on a new contract, and that he was ‘part and parcel’ of Nationwide’s operations.

Flawed HMRC interpretation of MOO disproven once more

Though considered a minor factor in this case, the tribunal once again disproved HMRC’s flawed interpretation of mutuality of obligation (MOO). Whereas the taxman argues that this condition is satisfied simply by there being a contract in place between two parties, MOO in the context of IR35 is concerned with an ongoing obligation on the hirer to offer work and for the worker to accept work.

Accordingly, Judge Hyde noted: “There was mutuality of obligation between the parties but only within each contract. Mr Less was engaged under separate contracts with no obligation on either party to extend or renew.”