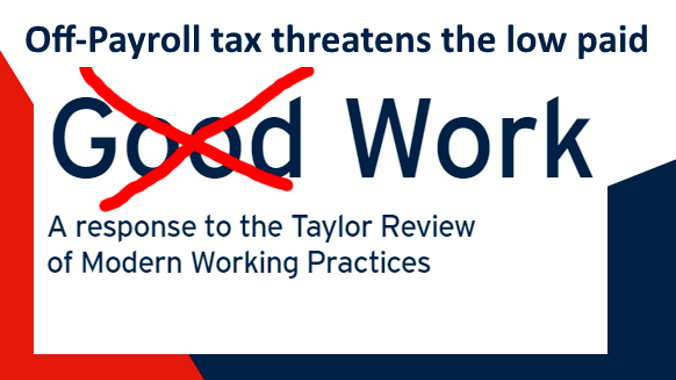

The Off-Payroll tax that HMRC is looking to impose on the private sector threatens to undo all of the work put into Government’s Good Work Plan, by actively inciting exploitation of the UK’s most vulnerable workers.

- Off-Payroll tax will nullify Government’s Good Work Plan

- Low paid workers are being forced to pick up hirer’s employer’s NI bills

- No means of appeal other than tribunal means no access to proper justice

- Government needs to consider aligning taxation with employment rights.

A response to the Taylor Review, the Good Work Plan aims to promote fairness in the labour market. Central to this is Government’s vow to protect those who it refers to as ‘dependent contractors’ from exploitation.

Ironically, the biggest threat to achieving this is proposed legislation in the form of the Off-Payroll tax. A misguided attempt at tackling perceived abuse of the tax system through bogus self-employment, the Off-Payroll tax, in fact, stokes non-compliance at the other end of the spectrum, enabling unscrupulous hirers to exploit low paid workers further.

How Off-Payroll incites exploitation of low paid workers

Government is tasked with addressing a perceived tax shortfall from false self-employment while attempting to level the playing field for low paid workers, the majority of whom are self-employed.

Its biggest mistake with Off-Payroll has been handing all the cards over to hirers, who have most to gain from flexible working arrangements. There are two key financial advantages to engaging self-employed labour for hirers, compared with hiring an employee:

- Avoiding employer’s National Insurance (NI) at 13.8%

- Not having to provide employment rights.

The first of these costs accounts for the vast majority of HMRC’s perceived tax shortfall, for which the hirer is now liable under Off-Payroll when a contractor is deemed ‘employed for tax purposes’.

But, as the public sector has shown, hirers are more than willing to blanket assess their workers as employed – to mitigate their own tax risk – while passing on the employer’s NI cost to the worker. This behaviour creates a significant burden for contractors.

So, what happens to those in precarious work with no bargaining power? The Department for Business, Energy & Industrial Strategy estimates there to be some 2.8m gig-economy workers in the UK, a large portion of whom have been forced into false self-employment for lack of a better alternative.

For them, the options are to either accept low paid work with an excessive and unfair tax deduction or go without. Despite the criminally unjust working conditions, many are forced to take the former option.

No access to justice, no employment rights

The matter is made worse by the fact that those affected have no realistic means of appealing their unfair tax treatment. HMRC maintains that contractors can contest their tax status at tribunal, or take their hirer to court. But what about those who don’t have thousands of pounds to spare for an appeal which will almost certainly outweigh any tax refund? These workers aren’t even provided with access to proper justice.

And, not only are these individuals overtaxed, they are also underprivileged. You would think that being treated as an employee for tax purposes would result in eligibility for the requisite employment rights, and this is an argument that was rightly put forward within the Taylor Review. Introducing this measure would reduce exploitation of precarious workers while providing a disincentive for those whom HMRC believes to be tax cheats from working ‘off-payroll’.

Yet, somehow, HMRC hasn’t seen fit to consider this proposal within its Off-Payroll consultation. Consequently, everybody loses out, but none more so than the low paid ‘self-employed’.

HMRC puts Good Work Plan in jeopardy

The inevitable fallout from the Off-Payroll tax is further non-compliance. By creating an additional tax burden for low paid workers, HMRC has made it significantly more difficult for them to pay their rent and bills and feed their families.

Some will be introduced to credible-looking schemes which promise a tax rate much closer to what they should realistically be paying. With little understanding of tax, many contractors unwittingly enter into what turn out to be tax avoidance schemes. And, just like that, the taxman has turned a cohort of low paid workers into tax cheats.

Everything outlined above is already rife in the public sector, yet HMRC still seems intent on introducing the Off-Payroll tax, and all of the collateral damage that comes with it, into the private sector.

If the Off-Payroll tax goes ahead, it will completely nullify the Good Work Plan. I have stressed these points face-to-face with HMRC. The taxman cannot continue to turn a blind eye to this issue. If it does, and we wind up several years down the line with nothing to show from the Government’s efforts, we will know why.