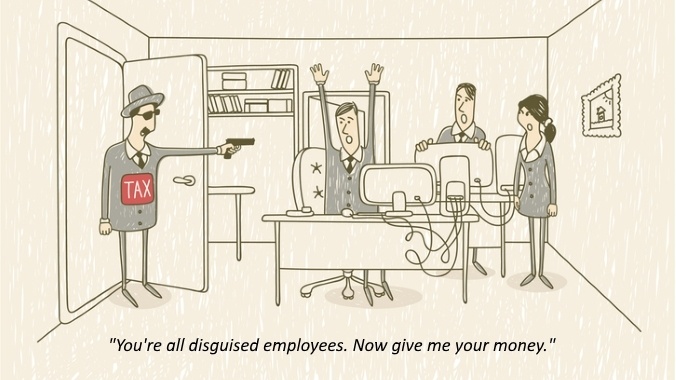

HMRC’s recent batch of letters to pharmaceutical giant Glaxo SmithKline (GSK) and its self-employed contractors are no better than the phishing letters sent by confidence tricksters designed to steal money from innocent victims. And what’s worse, this aggressive stance by the UK’s tax collection agency is not likely to encourage one of our largest employers to remain in the UK or to entice inward investment desperately needed post-Brexit.

But because HMRC is a government agency, somehow that makes this damaging strategy right? We don’t think so.

Similar to your average business scammer or boiler-house investment firm, HMRC’s Employment Status and Intermediaries Team has been busy sending out two batches of letters to two groups it plans to deceive.

The first letter from HMRC was sent to clients demanding “information about payments made via agencies to personal service companies (PSCs)”. Although it does have the legal right to demand information from one party about another party’s tax affairs, HMRC is purely fishing for information and, we are told, most likely has no comprehensive evidence of tax underpayment.

The second batch of letters was sent to contractors who worked with the aforementioned clients. These are just like those fake invoices from scammers designed to extract money by deception. Delivered without providing any proof of evidence, HMRC is telling contractors they are caught by the original off-payroll rules: Intermediaries legislation (IR35).

The letter also states that if the contractor disagrees, within a matter of weeks they – the taxpayer – “must” prove they are outside the off-payroll rules. HMRC will check if this has been done and if not, HMRC “may charge you a penalty”.

What the letters imply is that clients, global businesses and powerhouses of industry, such as GSK, are guilty of harbouring self-employed people who are allegedly evading tax. However, clients are only guilty of hiring the best talent so they can deliver world-class products, services and solutions that keep the UK’s economy strong.

The letters to contractors are even more alarming. Imagine receiving a letter from the Crown Prosecution Service (CPS) informing you that it considers you have committed a crime and you, not the police, have to prove you did not commit that crime? A dystopian vision of the future, you might think. But no, that’s now business as usual for the taxman.

Aside from the aggressive and frightening language, these letters do not constitute a formal enquiry and lack any statutory basis for the demands being made. Just like the fraudulent messages scammers send, these letters are designed to use fear and deception to make contractors pay money they may not owe. In fact, if a business or individual had written and sent them, they’d almost certainly sailing close to the wind with the law. How can a government department be allowed to do this?

What should contractors do in response?

There is no legal obligation to respond by the deadline, or in fact to respond at all. And HMRC can’t just fine taxpayers. To be fined, you have to have done something wrong and HMRC has to prove that before penalties apply.

But the advice from tax experts is not to ignore the letters. Firstly, contractors should immediately talk to their tax adviser and/or insurer (if they have tax investigation insurance). Your insurer may believe your IR35 risk is so low that no further action is required at this stage, but it is important you alert them.

Assuming your adviser/insurer agrees, you could ask the taxman some questions in return, such as: ‘how did you reach this view?’, ‘where is the evidence that supports it?’, and ‘what specific legislation underpins your letter, particularly the deadline, as you imply I have a legal obligation to comply?’.

HMRC also states that contractors “must” supply reasons for not agreeing with the taxman’s assessment that IR35 applies. Ask them what legislation requires this, specifically.

As a string of tax tribunal and court defeats demonstrate, the taxman won’t back down even when HMRC is incorrectly applying the legislation. So, contractors should be prepared to endure a possible investigation. Get a formal status assessment by a credible IR35 off-payroll rules expert of the contracts worked during the year HMRC mentions. If the expert finds it does apply, then pay the tax. It is the law, after all.

If the assessment shows you’re outside IR35 and the off-payroll rules do not apply, then that’s valuable evidence to use if, or possibly when, formally investigated.

But where does this all leave GSK, and no doubt other large UK-based businesses being targeted as the ‘enablers of tax crimes’? For starters, large clients targeted by HMRC might struggle to hire the best talent from the contractor marketplace.

Why go and work somewhere that puts you on HMRC’s radar? This happened in the public sector after new rules were introduced in 2017 and resulted in major health, justice and defence projects being negatively impacted. The BBC has got a ‘rep’ now as being a no-go-zone for self-employed talent, and the talent that does go there charges a premium for the risk.

Or, most frighteningly, we may see tens of thousands of contract roles and projects relocated outside of the UK to jurisdictions where the tax authorities don’t criminalise taxpayers by default. Then no-one gets any money, tax or otherwise, which is not a smart or sustainable strategy. It is, in fact, a strategy that will wreck the UK economy.