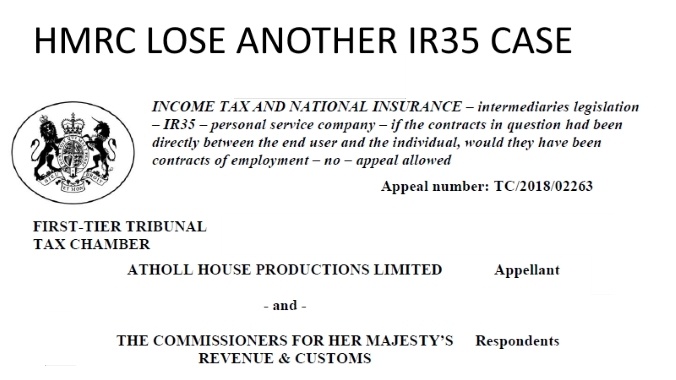

HMRC has been defeated in yet another high profile IR35 tribunal case, prompting further questions over the taxman’s competency and the expenditure of tens of thousands of pounds of taxpayer money on ill-considered IR35 cases.

Kaye Adams, broadcaster and journalist, successfully appealed a challenge to her self-employed status under the IR35 rules. This covered an engagement with the BBC as presenter of ‘The Kaye Adams Programme’ during the 2015/16 and 2016/17 tax years.

Adams’ numerous other engagements alongside her work at the BBC were central to the outcome, as they indicated that she was clearly in business on her own account.

“Within about ten minutes of the cross-examination of Adams’ editor, I was already questioning how the case had come this far,” comments ContractorCalculator CEO, Dave Chaplin, who attended the hearing. “This is yet another case of HMRC pursuing an individual over a frivolous case, wasting taxpayer money on the attempted retrieval of a sum which wouldn’t even have covered half of its own legal costs.”

Minimal MOO and editorial control not enough for HMRC

As Martyn Valentine, director of The Law Place, highlights, the outcome is also good news for many other BBC presenters targeted by the taxman:

“This judgment should provide comfort to other presenters currently being pursued by HMRC, who happen to be earning a significant proportion of their income from other sources, and who can demonstrate many years of being in business on their own account.

“While the ruling doesn’t set new legal precedent, it is considered persuasive,” he adds. “This means any similar future cases could refer to this one, indicating that the decision should be the same, though the first-tier tribunal wouldn’t be bound by this judgment.”

In another ruling exposing the taxman’s flawed and blinkered interpretation of IR35, the importance of considering the bigger picture was reaffirmed, as Adams’ work outside the BBC was central to her successful appeal.

As the presenter whom the radio programme was named after, there was no debate over the requirement for personal service, while the tribunal concluded that mutuality of obligation (MOO) was present.

Though practical indicators all suggested that Adams was largely in control of her work, it was acknowledged that the BBC held – yet never applied - a contractual right to exert editorial control. However, Judge Tony Beare concluded that this wasn’t sufficient:

“They [MOO and editorial control] will not, and in of themselves, suffice if the other terms of the relevant contract are inconsistent with the relevant contract’s being an employment contract.”

Chaplin comments: “The BBC certainly had the ultimate right of control over the content that was created, but not over how the content was created. Here, HMRC has made exactly the same mistake as in the Ackroyd judgment, in looking at control over the output as opposed to control over the individual, which is more concerned with the giving and receiving of orders.”

Adams’ other engagements key to tribunal outcome

The other terms were conclusive. Though her written agreement with the BBC suggested otherwise, oral evidence provided by Adams’ proved that the BBC didn’t have first call on her services and that she was free to enter into other engagements.

This was demonstrated by the fact that the BBC would often allow Adams to present the programme from alternative locations to enable her to fulfil other engagements such as public appearances. This, witnesses acknowledged, was key to maintaining and expanding Adams’ public profile and that of the programme.

“As usual, HMRC has placed too much emphasis on the written contract and too little on the working practices,” notes Chaplin. “HMRC can’t rely on the contract if both parties say that it doesn’t mean what it says. Notably, in the judgment, Judge Beare arrived at his main conclusion without relying on the terms of the contract at all.”

Because both sides indicated that the contract wasn’t aligned with the terms, Judge Beare was able to put aside the contract, citing Autoclenz v Belcher, focusing primarily on the actual arrangements in place.

“This is often a tactic used by HMRC to claim the contractual agreement is a sham, but in this instance, the ability to put aside the contract favoured the taxpayer,” comments Chaplin.

Adams is best recognised for regular appearances on ITV’s ‘Loose Women’ and ‘Paper Review’ on Sky News, in addition to writing regular columns for various newspapers and magazines.

The percentage of Adams’ earnings from other such engagements outside of her work with the BBC was a key element of the ruling. Judge Beare acknowledged that, on average, the figure equated to roughly 30%, adding: “It is therefore apparent that Ms Adams must have spent a meaningful part of her overall working time on those other engagements.”

“Had HMRC analysed Adams’ income in more detail, it would have realised that this case would almost certainly result in defeat, because she was getting a substantial proportion of her income from other clients,” says Valentine.

‘Kaye calls the shots’

Though the tribunal noted that the BBC ultimately held a contractual right to exert editorial control, it was acknowledged that this was never applied, as disagreements between Adams and the show’s producers were always resolved collaboratively.

As observed by Chaplin, oral evidence provided by Adams and the programme’s editor, Colin Paterson, demonstrated that Adams held a significant degree of control. This was evidenced by the fact that Adams would draft the scripts for the programme, with Paterson adding: “Kaye calls the shots.”

It was also acknowledged that which callers to take, what questions to ask and the direction that the show would follow, were all up to Adams’ discretion while the show was being aired.

HMRC argued that control over Adams was evident in the BBC’s contractual right to discipline her should she breach the BBC editorial guidelines or bring the organisation into disrepute. However, as Chaplin highlights, this made for a flimsy argument:

“You’d do very well to make a convincing case that a right to suspend someone is actually of itself a right of control. It needs to be accompanied by a right to give orders, which clearly wasn’t the case in this instance.”

Tribunal hearing exposes underhand HMRC tactics

While Adams’ representative, Rebecca Murray of Temple Tax Chambers, presented the facts, Chaplin claims the taxman failed to put forward a persuasive case. According to Chaplin, HMRC’s barrister, Elisabeth Roxburgh, even made the false assertion that Adams had an office at the BBC - a claim which was discarded by the Judge.

“If this was a boxing match, Murray would have won decisively, due to about a dozen knockout blows supporting Adams’ self-employed status,” notes Chaplin. “Roxburgh clearly put forward the strongest case she could but had been entered into a fight she could not win. Ultimately, she stepped into the ring, threw 100 punches and failed to land one.”

Though not included in the Judge’s summary, Paterson disputed notes compiled by HMRC concerning a meeting they had shared, which was subsequently used as evidence by the taxman. Paterson claimed that the notes didn’t portray an accurate reflection of his views, taking issue with the tone and some of the content.

“This is classic HMRC,” Chaplin adds. “An underhanded attempt to frame the taxpayer, in order to collect the maximum amount of tax. As evidenced by the recent review into the Loan Charge, HMRC is abusing its position, and there needs to be oversight quickly to prevent thousands of other taxpayers from being treated in this unjust manner.”

Do HMRC officers understand employment status

Keith Gordon, Barrister at Template Tax, who recently successfully defended Lorraine Kelly, expresses his concerns over whether HMRC officers are able to effectively deal with these cases:

"This latest IR35 decision emphasises that employment status is not determined by applying a checklist mentality. Instead, a key part of the approach requires stepping back from the individual details of a case and viewing the overall picture – a requirement that was made abundantly clear by the Court of Appeal a quarter of a century ago.

"That HMRC pursued this case to the Tribunal reveals one of two possibilities as to HMRC’s approach to media stars. Either HMRC officers are simply being greedy and are working their way routinely through the Radio Times with a view to obtaining tax that is largely not due. The slightly more charitable interpretation is that there is a fundamental misunderstanding of the tests of employment amongst those very HMRC officers who are charged with reviewing individuals’ employment status.

"Both possibilities are consistent with the evidence given by senior BBC executives to Parliament earlier this year where it became apparent that all was well until HMRC unilaterally adopted (and therefore imposed) new criteria without any proper justification, given that there had been no change in the law which necessitated any change of approach.

"What I find particularly disturbing is that the operation of the IR35 rules has since been changed primarily because HMRC persuaded Parliament that there was widespread non-compliance with the previous rules. Based upon the cases passing through the Tribunal, it would appear that a widespread misunderstanding of the rules by HMRC would be closer to the truth."

Adams v HMRC: UK taxpayers and CEST among other losers

Adams has won her case, but she will no doubt feel aggrieved at the cost at which it has come, a cost which was bloated by HMRC’s relentless and mistaken pursuit.

“Speaking briefly to Kaye after the tribunal, I mentioned that it was a travesty that HMRC had pushed the case this far, and reassured her that I thought she had an excellent chance of winning her appeal,” says Chaplin. “She was forced to spend tens of thousands of pounds defending herself in a case which HMRC never really stood a chance of winning. This is money she will not get back. I hope she was insured.

“UK taxpayers have a right to feel similarly frustrated. HMRC threw everything it had into this case and must have spent considerably more on it that the amount of tax at stake. How is that a fair use of taxpayer money?”

This loss will further dent public trust in HMRC and raise more questions over its Check Employment Status for Tax (CEST) tool. It highlights the importance of being ‘in business on your own account’ (IBOYOA), an employment status factor which CEST fails to consider.

“This judgment reaffirms the importance of looking beyond the contract and examining things holistically,” Chaplin concludes. “This is something which HMRC failed to do, and which CEST fails to account for, having been built based on the taxman’s flawed interpretation of IR35.

“We ran this case through CEST, which was ‘unable to determine’ Kaye’s status, despite her clearly not being caught by the rules. That’s the last two cases that have been won by taxpayers where CEST has indicated otherwise.

“HMRC needs to understand that IR35 is not a box-ticking exercise. It requires a degree of reasoning which HMRC has demonstrated that it, and certainly CEST, is incapable of. How can HMRC expect to sufficiently educate the private sector on how to apply the Off-Payroll rules, when it clearly cannot navigate the legislation itself?”