98% of IR35 status assessments carried out by High Speed 2 (HS2) in 2018 deemed the contractor to be caught by the Off-Payroll rules, fuelling suspicions of further non-compliance with the legislation in the public sector.

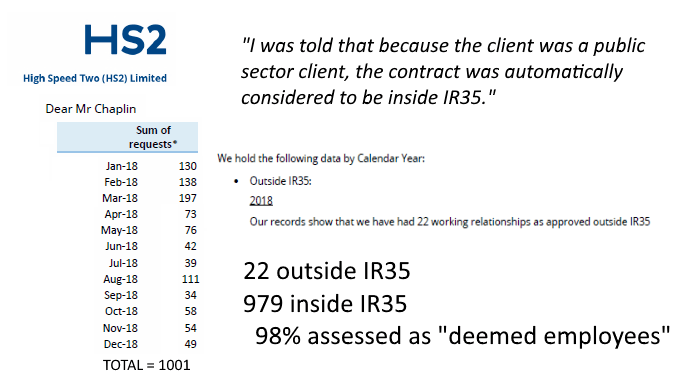

Responding to a Freedom of Information (FOI) request from ContractorCalculator, HS2 confirmed that 979 of the 1001 assessments conducted in 2018 returned an ‘inside IR35’ verdict, with only 22 contractors deemed outside the scope of the rules.

The absurd figures are strikingly similar to those recently returned to ContractorCalculator by Network Rail, which judged 99% of contractors to be caught by IR35 in 2018. Further information disclosed by Network Rail revealed that it had adopted an unlawful role-based ‘blanket’ approach to status assessments, which will raise questions about HS2’s own practices.

Why is HS2’s Off-Payroll pass rate so low?

Just last week, ContractorCalculator broke the news that FOI responses from Network Rail exposed what the public body had referred to as ‘a strawman process of determining status’.

This process involves assessing the status of generic roles using HMRC’s Check Employment Status for Tax (CEST) tool, before applying that determination to contractors undertaking the job. Despite being non-compliant with the Off-Payroll rules, Network Rail correspondence revealed that this practice was developed in conjunction with, and approved by, HMRC.

Though HS2 has not confirmed its own assessment processes, they are believed to be similar, with CEST again being used to make the final decision. Last year, ex-HS2 contractor James Horabin revealed to ContractorCalculator that project administrators had attempted to force all contractors into Pay As You Earn (PAYE) arrangements, in preparation for the public sector rules.

HS2 reportedly also told contractors that only those who could provide strong evidence to suggest that their working arrangements were outside of IR35 would be considered for a CEST assessment.

Subsequent accounts from contractors claiming to have interacted with HS2 since the public sector rules were introduced appear to confirm that:

- HS2 contracts are automatically considered to be ‘inside IR35’

- Contractors who have been assessed have been done so using CEST

One contractor, Gethin Gibbon told us: “I got a call from a recruitment consultant in January 2019 to ask if I was interested in a contract opportunity on HS2 based in Birmingham. I was told that because the client was a public sector client, the contract was automatically considered to be inside IR35. Because of my inability to claim expenses of £20K per year, this made the contract untenable, so I refused.”

Despite the substantial evidence to the contrary, HS2 has publicly denied non-compliant practices, stating: “We carefully considered how the changes to IR35 affected self-employed people working on the project alongside our obligations to abide by the legislation.

HMRC stands by CEST despite mounting evidence of bias

Compliance practices aside, the 98% of contractors considered caught by IR35 in 2018 alone is enough to warrant suspicion. The number is wildly inconsistent with HMRC’s estimation that roughly a third of contractors should find themselves caught by the rules, yet strikingly similar to the rough proportion of ‘inside IR35’ outcomes found by other public bodies using CEST.

“The proportion of contractors deemed within scope of the rules by the BBC, Network Rail and HS2 are 92%, 99% and 98% respectively,” highlights ContractorCalculator CEO Dave Chaplin. “These numbers are shocking enough.

“When you consider CEST’s well-documented deficiencies, and the fact that it recently returned the wrong result for the Lorraine Kelly tribunal case, there’s no question that this biased tool has forced many public sector contractors into false employment and for incorrect tax deductions to be made.”

In spite of the overwhelming conflicting evidence, HMRC has once again reiterated its confidence in CEST’s accuracy. Speaking to Recruiter last week, an HMRC spokesperson claimed: “It [CEST] is accurate and HMRC stands by the result if the tool is used correctly. CEST is not biased towards an employment outcome, giving a self-employed outcome the majority of the time.”

“The recent comments from HMRC are incredibly brazen. But, then again, we’ve come to expect nothing less from the taxman,” comments Chaplin. “The evidence provided by the public sector bodies is indisputable proof that HMRC’s claims are falsehoods.”

Off-Payroll ‘an act of self-harm on the public sector’

Whilst non-compliant application of the Off-Payroll rules has resulted in a sharp rise in the number of public sector contractors taxed as ‘deemed employees’, the unintended consequences of the legislation are already apparent, as Chaplin notes:

“This appalling treatment of the self-employed has backfired for Government. Rates to obtain talent have soared, while the ability to source talent has diminished, causing considerable costs to projects such as HS2.”

HS2’s decision to enforce blanket rules resulted in mass contractor walkouts and significant recruitment struggles, according to Horabin. Meanwhile, independent studies - including the HMRC-commissioned IFF Research report - have exposed the hiring challenges faced by organisations across the public sector.

“The IFF report acknowledged that 32% of surveyed central bodies reported significant hiring struggles following the reform, while 28% reported increases in contract rates,” Chaplin comments. “While these numbers are quite modest compared with other independent studies we have seen, they are still significant, yet this went unacknowledged by HMRC.

“As HMRC recently conceded, significant information was omitted from the final IFF report – information which it acknowledged could otherwise have impeded its ability to introduce the rules to the private sector. The omissions were possibly an effort to disguise the true impact of the Off-Payroll rules. In either case, HMRC’s ignorance of the public sector fallout has been incredibly damaging for all involved.”

Chaplin concludes: “The Off-Payroll rules have been an act of self-harm on the public sector, yet Government seems intent on inflicting the same wounds on the private sector.

“Government needs to delay its proposed extension for at least one more year while independent data gathering is conducted and recognise the hard truths about Off-Payroll that HMRC has so far refused to acknowledge.”