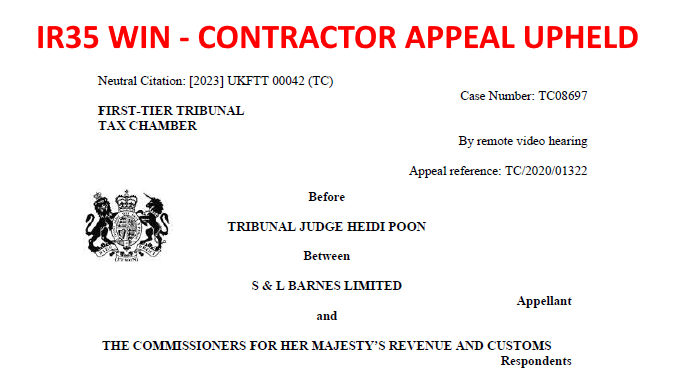

An IR35 appeal by Rugby expert Stuart Barnes to the First-tier tax tribunal ("FTT") has been upheld by Judge Heidi Poon. This appeal is the first Sky TV case upheld by the FTT after three previous appeals were dismissed.

This case concerned services provided by Mr Barnes, a top-level rugby union player throughout the 1980s and early 1990s. He then leveraged his expertise to become a published writer for various newspapers and magazines. He also worked with Sky Sports for 25 years, from 1994 to 2019, becoming known as 'the voice of rugby.' The appeal concerned the contracts between 6 April 2013 and 5 April 2019 when British Sky Broadcasting Limited engaged Mr Barnes.

The Tribunal hearing in July 2022 applied the three-staged test of Ready-Mixed Concrete ("RMC"), following the clarifications made in the Atholl House Court of Appeal ruling only a few months earlier, in April 2022. Whilst the pre-conditions within the first two stages of RMC were met, when applying the multi-factorial analysis at the third stage, Judge Heidi Poon concluded that the cumulative totality of the provisions in the hypothetical contract in the context of the parties' conduct and intention, meant that she considered the contracts would not have been contracts of employment, thereby upholding the appeal.

Dave Chaplin, CEO of IR35 Shield, said: "This is the fourth Sky TV case to go before the FTT, on almost identical contractual conditions, and the second after the crucial Atholl House Court of Appeal ruling.

"It's notable that the Tribunal constructed the hypothetical contract as largely a question of fact, using terms based on a combination of the documents between the parties, and partly from their conduct. That approach differs from the other Sky TV cases that have taken a more literalist approach to the construction. That approach may arguably be considered as causing too much violence to the actual contract, leaving the door open for a challenge by HMRC."

S&L Barnes Limited v HMRC – the tax under appeal

The tax being appealed under the "Relevant Periods" totalled £695,461. But, as always, these headline figures do not consider the tax already paid by the company and Mr Barnes, which would be offset. As a rule of thumb, any final bill is around one-third of the headline figure and closely aligns with the amount of secondary class 1 Employers' National Insurance that the hirer would normally pay.

The cruel reality of these appeals based on the original IR35 rules (Chapter 8 ITEPA 2003) is that the contractor has to pick up the hirer's tax bill. Whereas, under the new Off-payroll rules (Chapter 10 ITEPA 2003), the hirer is responsible. If Mr Barnes had been investigated under the new rules, it would be Sky TV having a huge tax bill, and not him.

Chaplin says: "The flawed design of the original rules, which passed the hirer's tax bill onto the contractor, is one reason why many firms in the media profession, including the BBC, insisted that sole traders incorporate and provide their services via limited companies.

Was HMRC complacent?

Previously dismissed IR35 cases involving the same broadcaster have been Little Piece of Paradise Limited ("LPPL"), McCann Media Limited ("MML"), and Alan Parry Productions Limited ("APPL"). Notably, the same Judge dismissed the appeal for LPPL. It appears that HMRC may have relied too heavily on her taking the same route this time, as highlighted by paragraph 83: "HMRC's Statement of Case and Skeleton Argument follow very closely the structure and flow of argument in Little Piece of Paradise v HMRC [2021] UKTT 369 ('LPP'), which is a decision by me on the personal service company of Mr Dave Clark as a TV presenter for Sky Sports. The framework agreements examined in LPPL adopted the same format and contained substantive terms practically identical to the contracts entered into between SLB and Sky in the present appeal. It is perhaps due to the fact that SLB's contracts are also with Sky that HMRC have made their case on similar facts and reasoning as set out in LPPL."

Chaplin says: "It's possible HMRC were overly complacent and believed the hearing was a case of just reeling in the same result they achieved previously with the same Judge. But, these media cases are highly fact-sensitive, and in this instance, Judge Heidi Poon also had the updated case law to traverse, compared to when she heard LPPL.

"Whilst the score at the moment on Sky TV is 3-1 to HMRC, one of those previous three cases is heading to the Upper-tier, so it remains to be seen what the outcome might be."

Facts versus law

More clues as to where HMRC failed, in this case, emerge in paragraph 95, where Judge Heidi Poon explained the different viewpoints of the parties on how the hypothetical contract should be constructed:

"95. I discern that it is the respondents' position that the hypothetical Contract should map closely to the terms of the actual Contract, while the appellant's position would seem to suggest that the Tribunal should bring in circumstantial factors outwith the terms of the actual Contract in the process of constructing the hypothetical Contract."

Then in paragraph 105, we see the finding that the contract alone should not be considered the sole agreement between the parties:

"105. While each Contract served as the framework agreement for the relevant period between the parties, I find that the parties did not intend the Contracts to be the exclusive record of the terms of their agreement. There was tacit understanding between the parties as to the practical aspects of the outworking of the contractual terms."

Then in paragraph 106, we see that the hypothetical contract was primarily constructed based on facts:

"105. …In line with this guidance, the terms of the Contracts in the present case are a question of fact, based on my finding that the terms of agreement between the parties are to be gathered partly from documents, and partly from their conduct."

Chaplin says: "This aspect of contractual interpretation and subsequent contractual construction of the hypothetical contract, based on the 'circumstances' in section 49(4) of the legislation, is a contentious one, which has previously been wrestled with by both the Upper-tier and Court of Appeal in Atholl House. In my view, in this instance, it is possible that it could be argued that too much violence has been made to the original Contract, leaving the door open for an appeal. But, whether this approach is an error in law or unchallengeable because it is part of the evaluative exercise under the remit of the FTT remains to be seen."

Are your status determinations unsafe?

Chaplin says that there is a fundamental lesson to be learnt from this case that ties into what he calls "unsafe status determinations."

The warning aligns with how contracts are drafted: "Where status determinations are made based on poorly drafted contracts, you can guarantee that HMRC is more likely to issue a tax bill, which can only be overturned by appealing to a costly tax tribunal.

"The expressed contract needs to be comprehensive because it avoids the very costly exercise of having to appeal to a tax tribunal based on forming a fact-based defence of the determination. Many of those facts may not be obtainable years after the Contract has been executed. Also, it may depend on which Judge hears the appeal because the interpretation of how to apply section 49(4) is subjective."

"Firms need 'Defendable determinations", whereby any inspection by HMRC quickly results in a favourable result. Determinations based too heavily on facts, and not the Contract, are asking for trouble."