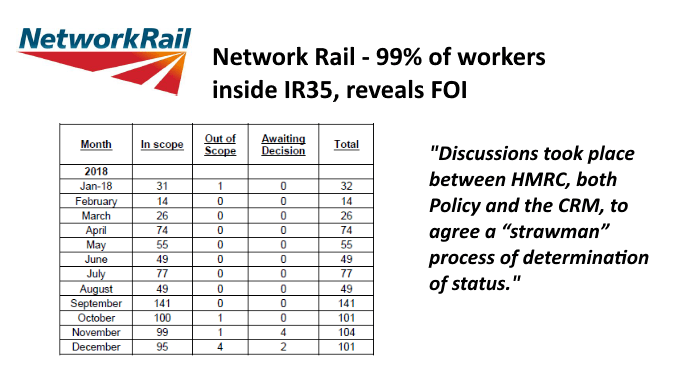

99% of contractors working for Network Rail were deemed by the public body to be caught by the Off-Payroll rules in 2018, an investigation by ContractorCalculator has revealed.

Responding to a Freedom of Information (FOI) request, Network Rail disclosed that only seven of the 817 contractors who were assessed over the course of the year were adjudged outside of IR35, while 810 were deemed caught.

This astronomical figure is a result of an unlawful role-based blanket approach agreed upon with HMRC, with assessments being conducted using the taxman’s flawed Check Employment Status for Tax (CEST) tool.

This far exceeds HMRC’s estimation that roughly a third of contractors are within scope of the legislation. It even eclipses the figure for the 92% of BBC freelancers who were contentiously deemed caught following the public sector Off-Payroll changes.

How has National Rail arrived at 99%?

“Simply put, Network Rail has found this ludicrous proportion of contractors to be caught by IR35 due to unlawful compliance practices,” notes ContractorCalculator CEO Dave Chaplin. “What’s most alarming is that its protocol was agreed following consultation with HMRC.”

Responding to a separate FOI request, Network Rail disclosed its correspondence with HMRC after being asked by the taxman to provide an update on its compliance practices following the April 2017 changes.

In its correspondence, Network Rail details a ‘strawman process of determination of status’, which it acknowledges was agreed upon following discussions with HMRC:

‘Within this area of contingent workforce, generic roles that would be covered were identified and categorised. The role itself was given a determination using the online tool and this determination was to be applied to whoever carried out such a role for the Company.’

“It’s unacceptable that HMRC has encouraged role-based assessments which defy the legislation, let alone acknowledge that it’s a strawman process which will have resulted in so many contractors being overtaxed,” comments Chaplin.

“This approach will also be putting a strain on Network Rail, for whom the cost of hiring each ‘deemed employee’ who previously operated outside of IR35 will have increased significantly increased in order to retain them.”

CEST bias contributes to almost impossible IR35 pass rate

Another key contributing factor to Network Rail’s absurdly low IR35 pass rate is its reliance on CEST for assessing the status of each individual role. In its correspondence with HMRC, Network Rail acknowledges that it has decided to use HMRC’s tool ‘in all cases without exception’, and that ‘the result arising from this would be final with no appeal’.

This is in spite of the fact that CEST has been continually exposed as inaccurate and biased. In August 2018, ContractorCalculator conducted a retesting of CEST against the 24 historical employment status cases HMRC claims were initially used to ascertain its accuracy. ContractorCalculator found it returned a flawed outcome 42% of the time.

More recently, when testing the details from TV presenter Lorraine Kelly’s IR35 tribunal victory, CEST incorrectly returned an ‘inside IR35’ outcome. This is particularly notable as the tribunal Judge stated in her judgment: “We do not consider this to be a borderline case.”

And earlier this month, when tasked with assessing the IR35 status for broadcaster Kaye Adams – another defeat for HMRC – CEST was unable to determine an outcome.

Network Rail response exposes HMRC and Treasury mistruths

The revelation from Network Rail has exposed the encouragement of protocols and practices from HMRC which is at odds not only with the Off-Payroll legislation, but also the messages coming directly from Government.

In correspondence to MPs in response to campaigning constituents, Financial Secretary to the Treasury Mel Stride has consistently argued that “most public authorities are making assessments on a case-by-case basis”. Stride has also drawn criticism for his claim that the genuinely self-employed will not be affected by the Off-Payroll rules.

HMRC also disregarded the issue of blanket assessments in its initial ‘Off-Payroll working in the private sector’ consultation. The taxman notably attempted to downplay the significance of blanket assessments by suggesting that they are only adopted in approximately 10% of engagements.

“It’s preposterous that HMRC and the Treasury continue to deny the issue of blanket assessments, when the taxman has been shown time and again to be actively encouraging this unlawful behaviour,” says Chaplin.

“It is exactly this sort of conduct for which the Loan Charge All-Party Parliamentary Group’s (APPG) Loan Charge Inquiry report recommended that HMRC be subject to some form of third party oversight.”

Unlawful Off-Payroll approach threatens future of contracting

As the figures from Network Rail suggest, incorporating CEST into a blanket approach to status assessments may, in many cases, result in almost unanimous ‘inside IR35’ outcomes. This is a compliance process which, as Chaplin highlights, would significantly drive up the cost of hiring contractors while impeding workforce flexibility:

“Our calculations show that, for firms that need to attract talent from further afield, the cost of engaging these individuals can increase by as much as 43%, once travel and accommodation have been factored into the equation. As we approach Brexit, firms can’t afford to pay more money for the same resources. Now is not the right time to be introducing these new taxes on business.

“If firms are encouraged by HMRC to do as Network Rail has done, there will be no point in hiring workers off-payroll, as everyone will be a ‘deemed employee’. Companies may as well place all workers on a payroll, and trade in their administrative costs for the extra 12-15% cost of hiring. This would at least ensure that contractors forced inside of IR35 receive the employment rights warranted by their new deemed tax status.”

Chaplin continues: “HMRC has gamed the system and, in the instance of Network Rail, has achieved its desired outcome – the retrieval of employer’s National Insurance Contributions (NICs) from almost the entirety of workforce engagements.

“But the fallout for contractors and hiring firms is severe. The injustice of such an approach to status assessments will prove a huge deterrent for would-be contractors, which will in-turn diminish flexible access to key skills for firms for firms unwilling to pay a premium. Those that are still risk the potential cancellation of existing projects due to spiralling costs.”

Chaplin concludes: “The best contractors simply won’t take on work unless they are fairly assessed and taxed. They certainly won’t work for 25% less money. The message is simple - to preserve the contracting sector and maintain labour market flexibility, hiring firms need to assess contractors on a case-by-case basis, and avoid CEST.”